Mortgage refinancing made simple and effective

Mortgage refinancing is a financial strategy that allows homeowners to replace their existing mortgage with a new one, often under more favorable terms. This process can provide various benefits, including lower interest rates, reduced monthly payments, or the ability to tap into home equity. Understanding the nuances of mortgage refinancing is essential for homeowners seeking to optimize their financial situation and make informed decisions.

By exploring different refinancing options, assessing potential advantages and drawbacks, and considering market conditions, homeowners can effectively navigate the refinancing landscape to achieve their financial goals.

Introduction to Mortgage Refinancing

Mortgage refinancing is a process in which an existing mortgage is replaced with a new loan, typically to achieve better financial terms. This practice serves various purposes, including obtaining a lower interest rate, adjusting the loan duration, or converting from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage. The goal of refinancing is often to reduce monthly payments, decrease the total interest paid over the life of the loan, or access home equity for additional financial needs.There are several types of mortgage refinancing options available to homeowners.

Each option caters to different financial circumstances and objectives. Homeowners must carefully consider these options to determine which aligns best with their goals and situations.

Types of Mortgage Refinancing Options

When exploring mortgage refinancing, it is essential to understand the types of refinancing options that are available. The following are some common types of refinancing:

- Rate-and-Term Refinance: This option allows homeowners to refinance their mortgage at a lower interest rate or change the loan term, which can reduce monthly payments or total interest costs.

- Cash-Out Refinance: This involves refinancing for more than the existing mortgage balance, allowing borrowers to take cash out for other financial needs, such as home improvements or debt consolidation.

- Streamline Refinance: Specific to government-backed loans like FHA or VA loans, this option simplifies the refinancing process, often without requiring extensive documentation or an appraisal.

- Interest-Only Refinance: This option allows borrowers to pay only interest for a specified period, potentially lowering initial monthly payments, though it may increase overall costs in the long run.

Advantages and Disadvantages of Refinancing a Mortgage

Refinancing a mortgage can offer significant benefits, but it also comes with potential drawbacks. Understanding these factors is crucial in making an informed decision.

Refinancing can provide lower monthly payments, access to cash equity, and the potential for a more favorable loan term.

The advantages of refinancing include:

- Lower Interest Rates: Homeowners may qualify for lower interest rates, leading to reduced monthly payments and overall interest costs.

- Access to Equity: Cash-out refinancing enables homeowners to access accumulated equity for various financial needs, such as debt consolidation or home improvements.

- Change Loan Terms: Refinancing allows homeowners to modify the loan duration, enabling them to pay off the mortgage faster or extend the repayment period for lower payments.

However, there are also disadvantages to consider:

- Closing Costs: Refinancing typically incurs closing costs, which can offset the savings gained from lower interest rates.

- Extended Loan Terms: A longer loan term may lead to more interest paid over the life of the mortgage, even if monthly payments are reduced.

- Potential for Unstable Rates: Refinancing into an adjustable-rate mortgage may result in fluctuating payments that could increase over time.

Reasons for Considering Mortgage Refinancing

Many homeowners explore mortgage refinancing as a strategic financial move to enhance their economic situation. Refinancing can provide an opportunity to lower monthly payments, access equity, or change loan terms, depending on individual circumstances. Understanding the motivations behind refinancing can guide homeowners in making informed decisions that align with their financial goals.Refinancing offers various benefits that can lead to significant savings.

Homeowners may choose to refinance to take advantage of lower interest rates, altering the duration of their loan, or converting from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage. Each of these adjustments can lead to reduced monthly payments and overall loan costs, creating an opportunity for financial relief or investment in other areas.

Common Reasons for Refinancing

Homeowners often have specific objectives when considering refinancing their mortgages. The following scenarios illustrate common reasons for this financial strategy:

- Lowering Interest Rates: With interest rates fluctuating over time, homeowners may refinance to secure a lower rate than their original mortgage, resulting in reduced monthly payments.

- Accessing Home Equity: Refinancing can allow homeowners to tap into the equity built in their property, providing funds for home improvements, debt consolidation, or other major expenses.

- Changing Loan Terms: Homeowners may want to shorten the term of their loan to pay it off more quickly, which can increase monthly payments but reduce total interest paid over the life of the loan.

- Switching Loan Types: Moving from an ARM to a fixed-rate mortgage provides stability in monthly payments, protecting homeowners from potential future rate increases.

- Improving Financial Situation: If a homeowner’s credit score has improved since the original loan was issued, they may qualify for better terms and rates, resulting in more favorable loan conditions.

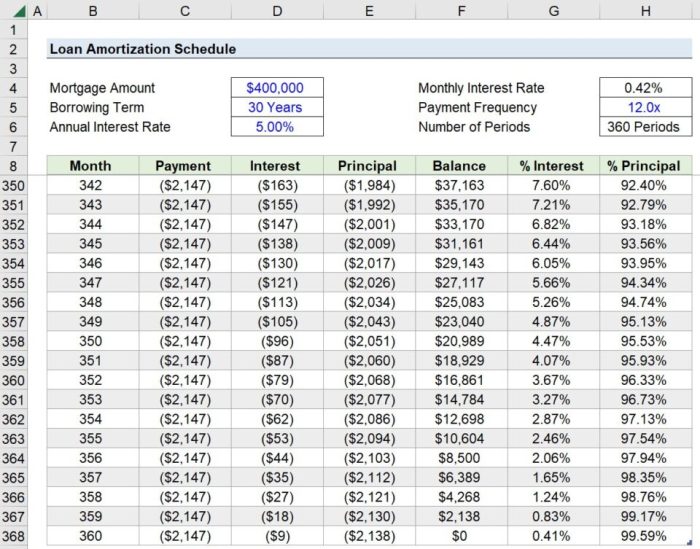

Refinancing can have a profound impact on monthly payments and overall loan costs. By obtaining a lower interest rate, even a small percentage decrease can lead to significant savings over time. For instance, a homeowner with a $300,000 mortgage at a 4% interest rate may pay approximately $1,432 monthly. If they refinance to a 3% rate, their payment could drop to around $1,265, saving them over $160 each month.

“A reduction in monthly payments can free up cash for savings, investments, or essential expenses, enhancing overall financial flexibility.”

Moreover, refinancing can alter the total cost of the loan. By extending the loan term, although monthly payments may decrease, homeowners might end up paying more interest over time. Therefore, a thorough analysis of one’s financial goals and circumstances is crucial before proceeding with refinancing. Homeowners should assess their long-term plans alongside immediate financial needs to ensure that refinancing is a beneficial choice.

The Mortgage Refinancing Process

The mortgage refinancing process can be a strategic move for homeowners seeking to optimize their financial circumstances. Understanding the intricacies involved is essential for a smooth experience. This section Artikels the steps of the refinancing process, the documentation required, and practical tips to enhance the likelihood of a successful application.

Steps Involved in the Mortgage Refinancing Process

The mortgage refinancing process typically includes several key steps that help ensure an effective transition to a new loan. Each step plays a critical role in achieving the desired outcome, whether it be reducing monthly payments or accessing equity.

- Assessment of Financial Goals: Homeowners begin by identifying their refinancing objectives, such as lowering interest rates, changing loan terms, or consolidating debt.

- Shopping for Lenders: It is advisable to compare various lenders to find the best rates and terms that align with financial goals.

- Application Submission: A formal application is submitted to the selected lender, initiating the refinancing process.

- Documentation Review: Lenders will assess the homeowner’s financial history, which is supported by the required documentation.

- Underwriting Process: The lender’s underwriting team evaluates the application and documentation to determine the risk involved in approving the loan.

- Loan Closing: Upon approval, the final loan documents are signed, and the new loan is funded, paying off the existing mortgage.

Required Documentation for Refinancing

Gathering the necessary documentation is crucial for a streamlined refinancing process. Lenders typically require specific information to evaluate your financial status thoroughly. The following documents are generally needed:

Proper documentation enhances the chances of loan approval and expedites the refinancing process.

- Proof of Income: Recent pay stubs, W-2 forms, or tax returns help demonstrate income stability.

- Credit Report: A report detailing credit history is essential for assessing creditworthiness.

- Property Information: Documentation such as the original mortgage agreement, property tax statements, and current homeowners insurance policy is required.

- Debt Information: Details of any outstanding debts, including credit cards and personal loans, need to be provided.

- Identification: A government-issued ID and Social Security number are necessary for identity verification.

Tips for Preparing to Refinance

Preparation is key when applying for mortgage refinancing. By following strategic tips, homeowners can improve their chances of approval and secure favorable loan terms.

Thorough preparation can significantly influence the approval process and loan conditions.

- Check Credit Score: Regularly reviewing your credit score can help identify areas for improvement before applying.

- Reduce Debt-to-Income Ratio: Paying down existing debt may enhance your financial profile and appeal to lenders.

- Document Financial Stability: Consistently saving or demonstrating income stability will provide reassurance to lenders.

- Consult with Financial Advisors: Expert guidance can clarify refinancing options and help tailor the approach to individual needs.

- Be Transparent: Providing accurate and complete information during the application process fosters trust with lenders.

Costs Associated with Mortgage Refinancing

Refinancing a mortgage is often seen as a strategic financial move, yet it is essential to understand the costs involved in this process. These expenses can impact the overall financial benefit of refinancing, making it crucial to weigh them against potential savings. A comprehensive understanding of these costs can aid homeowners in making informed decisions.There are various costs associated with refinancing a mortgage, many of which resemble those incurred during the initial mortgage process.

Understanding these costs is essential as they can significantly affect the overall savings derived from refinancing. While the primary goal of refinancing is often to lower monthly payments or secure a better interest rate, the initial outlay can be substantial. Homeowners must evaluate whether the savings gained over time will outweigh these upfront costs.

Typical Fees Associated with Refinancing

When considering refinancing, it is important to be aware of the various fees that may apply. Below is a table summarizing common costs associated with mortgage refinancing, along with explanations for each fee.

| Fee | Explanation |

|---|---|

| Application Fee | A fee charged by the lender to process the loan application. It may cover the cost of credit checks and other administrative tasks. |

| Origination Fee | Charged by the lender for evaluating and preparing the mortgage loan. This fee is typically a percentage of the loan amount. |

| Appraisal Fee | The cost for a professional appraiser to determine the current market value of the property, which impacts the loan amount. |

| Title Search and Title Insurance | A fee for researching the property’s title history and ensuring there are no liens or legal issues, along with insurance to protect against title discrepancies. |

| Closing Costs | These encompass various fees that might include recording fees, attorney fees, and other miscellaneous costs associated with finalizing the loan. |

| Prepayment Penalty | Some lenders charge a fee if the homeowner pays off the existing mortgage early, which can affect the cost-effectiveness of refinancing. |

| Escrow Fees | Fees related to managing the escrow account for property taxes and insurance, which may be required by the lender during refinancing. |

When analyzing the costs of refinancing, it is vital to compare them against the potential savings over time. For instance, if the total refinancing costs amount to $5,000, and the homeowner stands to save $200 a month from reduced payments, it would take approximately 25 months to recoup the costs. Evaluating this timeline can help determine if refinancing aligns with the homeowner’s financial goals, especially if they plan to stay in the home long-term.

“Understanding the costs involved in refinancing a mortgage is crucial for making an informed financial decision.”

Timing Your Mortgage Refinance

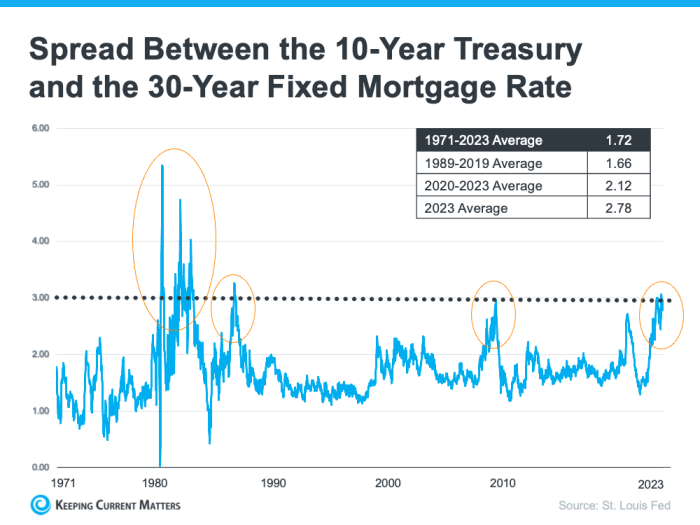

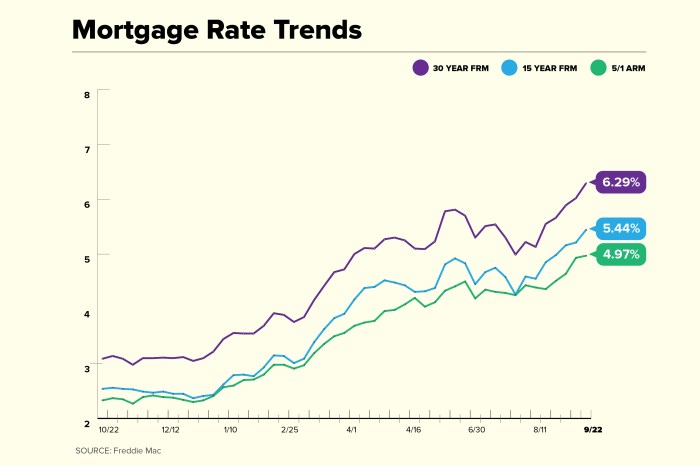

Timing plays a crucial role in the decision to refinance a mortgage. The right timing can lead to significant savings and enhanced financial stability, while the wrong timing may negate these benefits. Understanding market conditions, interest rates, and personal financial situations is essential for making an informed decision.Market conditions can greatly influence the decision to refinance. The primary factor to consider is the prevailing interest rates in comparison to your current mortgage rate.

When interest rates drop significantly below your existing rate, refinancing can reduce your monthly payments and the overall interest paid over the life of the loan. Moreover, other economic indicators, such as inflation rates and housing market trends, can provide context for refinancing opportunities.

For those looking to navigate their personal finances effectively, a personal financial consultant can provide invaluable insights. These professionals assist clients in budgeting, debt management, and investment choices, empowering them to make informed decisions and reach their financial aspirations with confidence.

Indicators of a Favorable Time to Refinance

Recognizing specific indicators can help determine whether it is an opportune moment to refinance your mortgage. These indicators typically signal favorable market conditions or personal financial readiness. Below are key indicators to consider:

- Interest Rate Decrease: A substantial drop in market interest rates compared to your current mortgage rate is a strong indication that refinancing may be beneficial. For instance, if your current rate is 4.5% and market rates drop to 3.5%, you stand to gain from refinancing.

- Improved Credit Score: If your credit score has improved since you first secured your mortgage, you may qualify for lower interest rates. This improvement can lead to better loan terms and potentially significant savings.

- Increased Home Equity: A rise in your home’s value can increase your equity position, making it easier to refinance and possibly obtain better loan terms. For example, if your property has appreciated significantly, it may allow you to refinance without private mortgage insurance (PMI).

- Change in Financial Situation: Any positive changes in your financial situation, such as a rise in income or a reduction in debt, can enhance your refinancing prospects. Such changes may make you a more attractive candidate for lenders.

- Shortened Loan Term: If you are considering refinancing to a shorter loan term (for instance, from a 30-year mortgage to a 15-year mortgage), the timing should coincide with low interest rates to maximize benefits while minimizing long-term interest payments.

“Timing is not just about market conditions; it is also about your financial readiness and long-term goals.”

Impact of Credit Score on Refinancing

The credit score plays a pivotal role in determining the refinancing options available to homeowners. It is a numerical representation of an individual’s creditworthiness, calculated based on their credit history. A higher credit score typically leads to better refinancing terms, making understanding this impact essential for anyone considering refinancing their mortgage.The relationship between credit scores and refinancing options is significant.

Lenders use credit scores to assess the risk of lending money, which influences the interest rates and terms offered. A borrower with a higher credit score is perceived as a lower risk, resulting in more favorable interest rates and potentially lower monthly payments. Conversely, those with lower credit scores may face higher interest rates or even difficulty securing refinancing.

Effects of Varying Credit Scores on Refinancing

Understanding how different credit score ranges influence mortgage refinancing can provide insight into potential financial outcomes. Generally, credit scores fall into various categories, each with distinct implications for refinancing:

- Excellent Credit (740 and above): Homeowners in this range are likely to secure the best rates available, which can lead to substantial savings over the life of the loan.

- Good Credit (700 – 739): Borrowers may still access competitive rates, although they may not be as low as those available to individuals with excellent credit.

- Fair Credit (640 – 699): Refinancing options may be limited, and rates will generally be higher, resulting in increased monthly payments and overall interest paid.

- Poor Credit (639 and below): Homeowners may face significant challenges in refinancing, including higher rates and possibly being denied a loan altogether.

Improving a credit score before refinancing can have a substantial impact on the financial terms available. Here are effective strategies to enhance credit scores:

- Pay Bills on Time: Timely payments contribute positively to credit history, which is a key factor in credit scoring.

- Reduce Outstanding Debt: Lowering credit card balances can improve the credit utilization ratio, positively impacting credit scores.

- Avoid New Credit Inquiries: Limiting new credit applications can prevent negative impacts on credit scores, particularly in the short term.

- Check Credit Reports for Errors: Regularly reviewing credit reports and disputing inaccuracies can help ensure a fair representation of one’s credit history.

The differences in credit scores not only affect the ability to refinance but also impact monthly payments and total interest paid over the life of the loan. For instance, a homeowner with an excellent credit score who secures a 3.5% interest rate versus another with fair credit at 5.5% could illustrate a significant financial variance. If both are refinancing a $300,000 mortgage over 30 years, the monthly payment for the higher rate could increase by over $200, which adds up to thousands more in interest over the loan term.

“Improving your credit score can lead to lower interest rates and significant savings on your mortgage refinance.”

Choosing the Right Lender

Selecting the appropriate lender for mortgage refinancing is a crucial step in achieving favorable loan terms and ensuring a smooth refinancing process. With various lenders available, understanding their differences and identifying the right fit for your financial needs can significantly influence your refinancing experience.Different types of lenders offer unique benefits and terms for mortgage refinancing. Generally, these can be categorized into traditional banks, credit unions, online mortgage lenders, and mortgage brokers.

Each of these lenders has its advantages and considerations.

A wealth management advisor plays a crucial role in helping clients achieve their financial goals through tailored investment strategies and comprehensive planning. By engaging with a wealth management advisor , individuals can receive expert guidance on asset allocation, risk management, and long-term financial growth, ensuring a secure financial future.

Types of Lenders for Refinancing

When considering lenders, it is essential to evaluate the following types:

- Traditional Banks: Typically offer a wide range of financial products and may provide competitive rates for existing customers. Their established reputation can lend credibility, but they may have stricter lending criteria.

- Credit Unions: Often provide lower fees and better rates due to their nonprofit status. Membership requirements may limit eligibility, but they value customer service and community engagement.

- Online Mortgage Lenders: Generally boast efficiency and convenience, offering quick applications and responses. Their streamlined processes often come with competitive rates, but personal interaction may be limited.

- Mortgage Brokers: Act as intermediaries who can help you find the best loan products from various lenders. They can save time and effort, but their services may come with additional fees.

Criteria for Selecting a Lender

Identifying the right lender requires careful consideration of several factors that can affect your refinancing decision. Below are critical aspects to evaluate when selecting a lender:

- Interest Rates: Compare the interest rates offered by different lenders to ensure you are getting a competitive deal. Even a small difference in rates can lead to significant savings over the life of the loan.

- Fees and Closing Costs: Assess all associated fees, including application fees, appraisal fees, and closing costs. A lender with lower fees can save you more money.

- Customer Service: Review customer feedback and ratings to gauge the level of service provided by the lender. Responsive and helpful client support is vital throughout the refinancing process.

- Loan Options: Ensure the lender offers a variety of refinancing products that align with your financial goals, such as fixed-rate or adjustable-rate options.

Negotiating Better Terms with Lenders

Negotiating with lenders can lead to better terms and conditions on your refinance loan. Here are some effective strategies for negotiation:

- Do Your Research: Gather information about current market rates and offers from different lenders. Having data empowers you during negotiations and demonstrates that you are an informed borrower.

- Leverage Competing Offers: Present competing offers from other lenders to negotiate better terms. Lenders may match or improve upon these offers to secure your business.

- Ask for Waivers: Inquire if the lender is willing to waive certain fees, such as origination fees or appraisal costs, especially if you have a strong credit profile.

- Highlight Your Creditworthiness: Present your strong credit score and payment history as negotiating points. A good credit profile could push lenders to offer more favorable rates.

Understanding Interest Rates in Refinancing

Interest rates play a pivotal role in mortgage refinancing, significantly influencing the decision-making process for homeowners. A clear understanding of how these rates are determined and the options available can help borrowers make informed financial choices.Interest rates for refinancing are primarily determined by a combination of macroeconomic factors, including inflation, economic growth, and monetary policy set by the Federal Reserve.

Additionally, individual factors such as credit score, loan-to-value ratio, and overall market conditions also contribute to the rates offered by lenders. As market conditions fluctuate, so too do the interest rates, which can create opportunities for potential refinancers to secure a better deal.

Fixed vs. Variable Interest Rates

When considering refinancing options, borrowers often encounter two primary types of interest rates: fixed and variable. Each type has distinct characteristics that can impact the overall cost of the loan and the borrower’s financial stability.Fixed interest rates remain constant throughout the life of the loan, providing predictability in monthly payments. This stability can be particularly advantageous in an environment where interest rates are expected to rise, as borrowers can lock in a lower rate for the duration of their mortgage.In contrast, variable interest rates (also known as adjustable rates) can fluctuate based on market indices.

While these rates may start lower than fixed rates, they can increase over time, resulting in higher monthly payments if market conditions shift unfavorably. Borrowers must carefully assess their risk tolerance and financial situation when choosing between these options.

For example, if a homeowner refinances a $300,000 mortgage with a fixed rate of 3.5% versus a variable rate that starts at 3% but could possibly rise, the choice can lead to significantly different financial outcomes over the loan’s term.

Understanding the implications of interest rate trends is crucial in making a refinancing decision. A slight change in rates can result in substantial differences in repayment amounts and total interest paid over the lifetime of the loan. Therefore, monitoring economic indicators and market trends can be beneficial for homeowners considering refinancing options.

Long-Term Implications of Refinancing

Refinancing a mortgage can have significant long-term effects on an individual’s financial situation and future property investments. While the immediate benefits of refinancing often include reduced monthly payments and a lower interest rate, it is crucial to consider how these changes may impact long-term financial goals such as retirement planning, wealth accumulation, and property equity.The decision to refinance can influence not only monthly cash flow but also the overall equity and value of the property over time.

Equity is essentially the difference between the market value of a home and the outstanding mortgage balance, and it plays a vital role in a homeowner’s financial health. When refinancing, homeowners must weigh both the advantages and drawbacks to make an informed decision.

Long-Term Benefits and Potential Pitfalls of Refinancing

Understanding the long-term implications of refinancing aids in making informed decisions that align with financial goals. Below are potential long-term benefits of refinancing compared to the pitfalls that may arise:Long-Term Benefits of Refinancing:

- Lower Interest Payments: A reduced interest rate can significantly lower the total amount paid over the life of the loan.

- Increased Cash Flow: Lower monthly payments can free up cash for other investments or savings, enhancing overall financial flexibility.

- Access to Home Equity: Cash-out refinancing allows homeowners to tap into their property equity for major expenses, such as home renovations or education costs.

- Potential Tax Benefits: Mortgage interest may still be tax-deductible, depending on individual circumstances and prevailing tax laws.

- Improved Credit Profile: Regular payments on a new mortgage can help improve credit scores over time, positively influencing future borrowing opportunities.

Potential Pitfalls of Refinancing:

- Closing Costs: Upfront costs associated with refinancing can be substantial and may negate short-term savings if not carefully considered.

- Extended Loan Terms: Opting for a longer loan term to lower monthly payments can lead to paying more in interest over time.

- Market Fluctuations: Changes in property values can affect equity and financial stability if the market declines post-refinancing.

- Impact on Credit Score: The process of refinancing can result in temporary dips in credit scores due to credit inquiries and changes in credit utilization.

- Potential for Over-leverage: Cash-out refinancing increases the loan amount and may lead to higher debt levels, impacting financial security.

“Refinancing is not just a transaction; it’s a strategic move that can shape your financial future.”

Conclusive Thoughts

In conclusion, mortgage refinancing presents a valuable opportunity for homeowners to enhance their financial standing. By carefully weighing the benefits against the costs and considering timing and lender options, individuals can make sound decisions that align with their long-term objectives. Ultimately, a well-executed refinancing process can lead to significant financial relief and increased stability.

Query Resolution

What is the best time to refinance my mortgage?

The best time to refinance is typically when interest rates are lower than your current rate, or when your credit score has improved significantly.

Will refinancing hurt my credit score?

Refinancing may cause a temporary dip in your credit score due to hard inquiries, but it can improve your score if it results in lower debt-to-income ratios.

How long does the refinancing process take?

The refinancing process usually takes between 30 to 45 days, depending on the lender and the complexity of your application.

Can I refinance with bad credit?

While it is more challenging to refinance with bad credit, some lenders offer options specifically for those with lower scores, although rates may be higher.

What should I do if my home value has dropped?

If your home value has dropped, it may limit your refinancing options, but it’s still worth consulting with lenders to explore potential solutions.